Overview

2025 brought a new change to Black Friday Cyber Monday with the introduction of “Black November.” Brands began offering promotions much earlier and for a longer period than previous years. In fact, some Cyber Monday deals are still running as of the publication of this report. This pull forward of purchasing was well expected but left questions as to the impact it would have on consumer spending during the Thanksgiving through Cyber Monday (Cyber Five) period.

Despite these earlier promotions, spending momentum during the core holiday period remained strong. Data from Stord Collective partner, Facteus, indicates that although daily spend in October reached 80% of Cyber Five levels,1 there was still substantial sales growth during the Black Friday Cyber Monday (BFCM) shopping event.

In the United States, Black Friday continued to be the single largest spending day. According to Adobe, shoppers spent $11.8 billion during Black Friday, representing a 9.1% year-over-year growth. Black Friday accounted for 26.7% of the total Cyber Five spend. However, e-commerce activity peaked on Cyber Monday, which generated $14.25 billion in sales, an increase of 7.1% from 2024.

Overall, U.S. transaction volume for the entire BFCM period in 2025 grew by 7.7% year-over-year. This surge contributed to total Cyber Five sales reaching $44.2 billion, up from $44.1 billion in 20242 which was earned through 716M transactions, according to Facteus.

BFCM Performance by Stord Customers

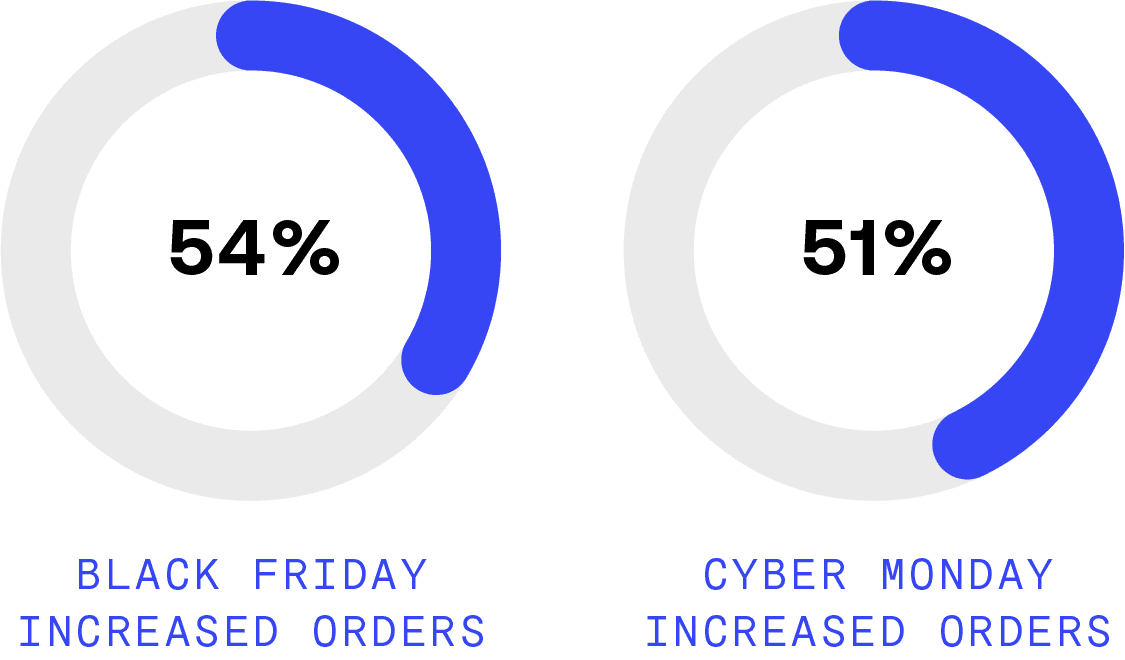

Stord customers experienced record-breaking performance this BFCM. Black Friday orders rose 54% year-over-year, while Cyber Monday orders increased 51%. On Thanksgiving, sales increased by 62% year-over-year, and the days between Black Friday and Cyber Monday saw a combined average growth of 42%.

This peak also witnessed a markedly extended sales period, dubbed Black November. This led to elevated sales volume throughout October and November, and looks to be positively impacting early December as well.

These spikes coincided with Stord’s highest orders shipped per day in company history through Stord One Warehouse, Stord’s proprietary warehouse management system, during Cyber Monday compared to 2024.

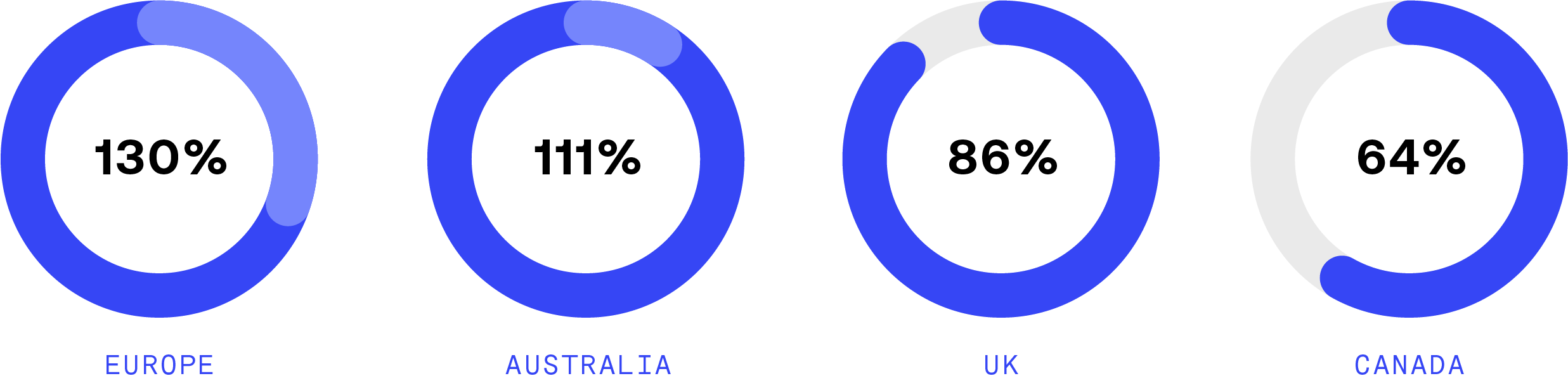

International demand also surged. On Black Friday alone, international orders grew 75% week-over-week, driven by substantial increases across key regions: 130% in the EU, 111% in Australia, 86% in the UK, and 64% in Canada. Cyber Monday continued this momentum with a 38% week-over-week increase, with a 30% rise in Australia and 15% growth in Canada, the UK, and the EU. Overall, Cyber Monday outperformed Black Friday in international sales with approximately 14% higher total order volume.

Even with this extraordinary growth in volume, Stord maintained exceptional operational performance. Our average click-to-ship time reduced by over an hour on every order, sticking to around one-day or less, providing Stord customers with a crucial advantage over competitors . The current industry standard regularly sees Peak click-to-ship times expand to 3-4 days, negatively impacting the consumer experience. Stord’s accelerated speeds underscores the resilience and maturity of our global network.

As brands looked to improve their consumer experience, Stord was ready to support. During just Black Friday and Cyber Monday, Stord saw a 239% increase in kits assembled as more brands empowered customers to purchase larger orders through custom bundles.

Industry Performance

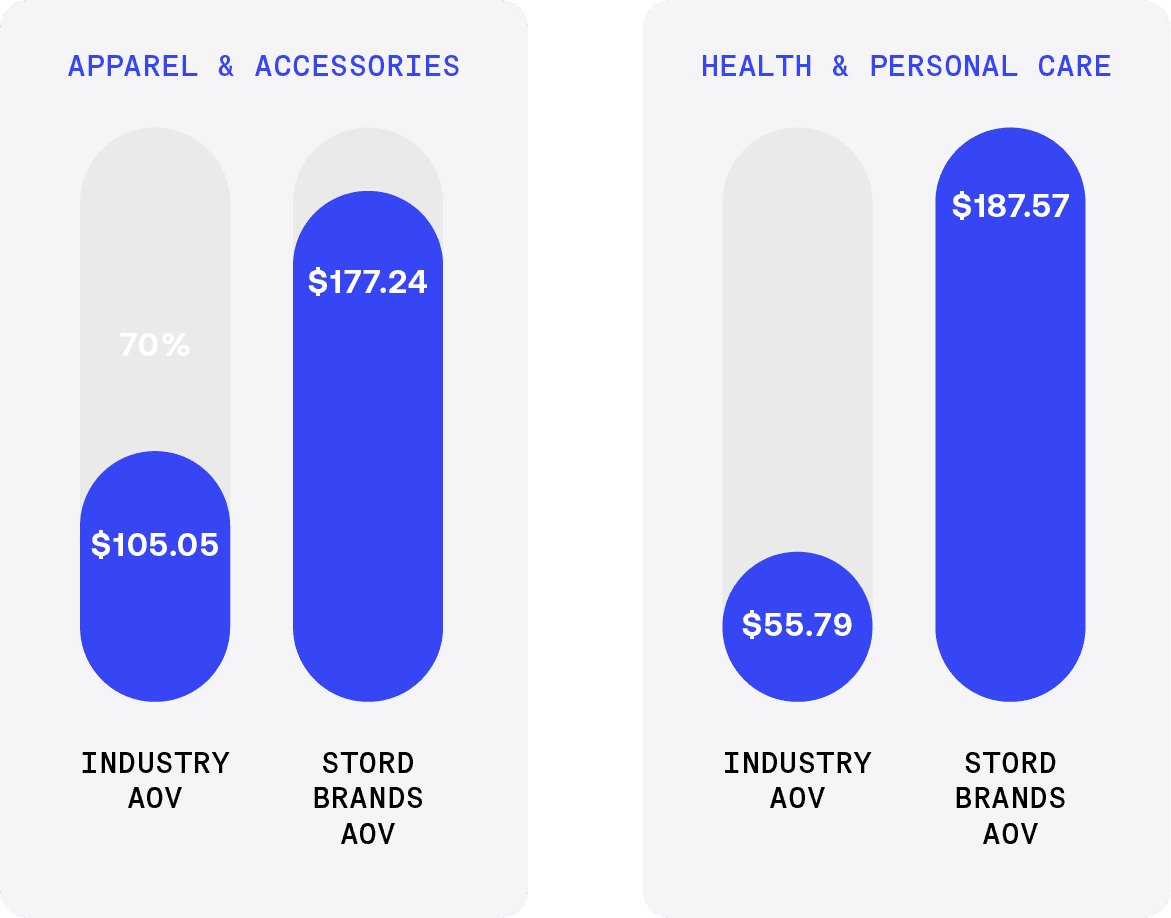

Stord customers also significantly outperformed industry benchmarks this BFCM, demonstrating stronger customer purchasing behavior and higher basket values across key categories.

According to Facteus, the Apparel & Accessories category during Black Friday recorded an industry average order value (AOV) of $105.05. In contrast, Stord customers in the same category achieved an AOV of $177.24, nearly 70% higher. The gap was even more pronounced in Health & Personal Care, where the industry AOV was $55.79, while Stord brands reached an exceptional $187.57.

Cyber Monday followed a similar trend. Apparel & Accessories brands across the industry averaged a $100.78 AOV, yet Stord brands nearly tripled that performance with an AOV of $274.31.

For a more detailed breakdown of day by day performance and specific industry trends please see our Black Friday Cyber Monday Live Tracker.

Peak Parcel Surcharge Savings

While overall sales during BFCM showed significant year-over-year growth, the peak holiday shopping season consistently presents challenges for brands, chief among them the escalating peak surcharges imposed by parcel carriers driven by increased shipment volumes and demand. Even during non-peak periods, shipping expenses alone typically consume 10-15%3 of a brand’s total revenue.

This year, brands faced even greater pressure following widespread parcel rate hikes implemented earlier this year across major carriers. Entering the holiday shopping season, these surcharges intensified. FedEx, UPS, and Amazon imposed additional handling surcharges reaching as high as $10.80 per package in some cases, alongside demand surcharges ranging from $0.40 to $3.55 depending on service level.4 USPS also implemented an average surcharge increase of 5% across its services.5 Collectively, these peak-season fees placed substantial strain on brand margins.

Despite these industry-wide cost increases, Stord customers were able to mitigate much of the impact. By leveraging Stord’s extensive multi-node network of national and local carriers across the U.S., Stord customers realized meaningful savings compared to standard listed surcharge rates.

On average Stord customers saved 36% on peak surcharges.

That percentage represents only the additional savings captured during peak season, on top of the everyday parcel savings Stord already delivers to its customers.

Consumer Spending Trends for BFCM

Stord customers’ strong AOV performance becomes even more meaningful when viewed alongside broader consumer spending patterns during BFCM 2025. Generational spending data from Facteus reveals important shifts that will influence how brands should position themselves heading into 2026.

Gen Z continued to emerge as a fast-growing but value-driven consumer group. They spent $1.21 billion during BFCM, an impressive 12.9% increase year-over-year. Although their overall buying power remains limited due to college debt, age, and being early in their careers, their spending was highly concentrated in apparel. This reinforces a clear message for brands that when targeting Gen Z, high-ticket, high-consideration items are less likely to convert. Instead, accessible, trend-forward, durable essentials resonate most strongly.

Millennials followed with 8.8% year-over-year growth, contributing $10.60 billion in total spend. Gen X, despite lower growth at 7%, outspent both Gen Z and Millennials combined with $11.98 billion in purchases. Baby Boomers continued to drive the highest absolute spend at $13.21 billion, though their growth slowed to 6.2%. Notably, Baby Boomers dominated electronics purchases with $730 million spent, representing 36.6% of the category. Despite the 9.5% decline in electronics spending during Cyber Five, it saw a 12.86% year-over-year increase in October. It is one of the categories that highly benefited from the Black November trend as consumers increasingly decide to purchase high-ticket items over a longer period of time to spread out their spending between paychecks.

Across generations, it is clear that consumers are buying what matters to them. With broader access to AI-driven product discovery, TikTok shop, social commerce, and other more personalized deal-finding tools, shoppers are no longer rushing into stores or defaulting to generic promotions. They are curating their own shopping experiences at scale.

As consumer choice becomes increasingly self-directed and digitally influenced, brands must sharpen their strategies and meet buyers where they are. As consumers become more selective and comparison-driven, fast shipping, accurate inventory, and reliable fulfillment - areas where Stord is already delivering at scale - will continue to influence conversion and loyalty not just during Peak but all throughout the year.

Total Performance

Black Friday Cyber Monday 2025 proved to be another landmark year for Stord customers and U.S. commerce, with consumers driving $47.5 billion in online sales. Stord supported a rapidly expanding portfolio of brands that collectively achieved record-breaking performance year-over-year. Our customers achieved stronger margins benefitting from Stord’s surcharge savings and consistently fast fulfillment.

As we move into 2026, Stord remains committed to powering the next era of commerce growth through our ambitious AI-initiatives, an expanding fulfillment network, and even greater economies of scale.

If your BFCM 2025 results fell short of expectations, talk with us to explore how Stord can help your brand deliver an award winning consumer experience in 2026.

MARKET DATA AND INSIGHTS DISCLAIMER

This Report is for informational purposes only and is based on preliminary, aggregated, and anonymized data. Stord provides this information "as is" and makes no warranty as to its accuracy or completeness. Stord disclaims all liability for any business decisions or projections made based on this Report.