E-commerce brands are facing growing pressure to keep up with consumer expectations around delivery speed and convenience. Today’s shoppers expect near-instant gratification once they click "buy." These expectations reach an all-time high during peak shopping periods like Black Friday Cyber Monday (BFCM) and the holiday season, when customers demand that products arrive on time for events or celebrations.

The average consumer’s willingness to wait for orders decreased from 2.36 days in 2022 to 2.15 days in 2023, with variations depending on the product category. Health, pharmaceutical, alcohol, and financial products have shorter expected delivery times, ranging from 1.59 to 1.73 days. Meanwhile, online shoppers are slightly more patient with categories like automotive and fashion, where wait times can stretch up to 2.5 days.1 This shift in expectations is further supported by a McKinsey survey2 showing that across categories, nearly 90% of consumers are willing to wait a maximum of 3 days for delivery. Patience drops exponentially beyond that point, with longer wait times often leading to customer dissatisfaction and lost sales.

To keep pace, many brands are distributing inventory across multiple locations to stay closer to demand and maintain delivery speed even during peak periods. Proactive communication can also help offset a less than ideal delivery experience. Over 90% of consumers are willing to wait longer for an order to arrive so long as it has been clearly communicated.3 Messages like “Need it by [date]? Order before [date].” is a great way to shape expectations around delivery, preserve trust, and maintain a positive customer experience. That said, proactive communication should be partnered with a reliable, distributed fulfillment in order to reduce the strain of peak season demand.

While a single-node setup is a practical approach in the early stages as it allows for tighter control over operations, inventory, and costs, it becomes less effective as demand scales and peaks. Once order volume increases and customers spread out geographically, relying on one fulfillment center can impact your bottom line.

For example, take a fast-growing brand that continues to fulfill every BFCM order from a single facility on the East Coast. As orders start pouring in from California, Washington, and Texas, each parcel still leaves from the same location, regardless of the final destination. When customers on the West Coast start experiencing higher shipping costs and order delays, frustration builds and complaints start rolling in.

At this point, the weaknesses of a single-node model become harder to ignore. Longer shipping distances lead to slower deliveries. In an attempt to maintain delivery promises, brands may turn to air or expedited ground services. But that speed comes at a steep cost. Absorbing those costs can squeeze margins, especially when shipping costs alone typically eat up 10-15% of a brand’s total revenue.4 On the other hand, passing those costs on to the consumer risks backlash over high shipping fees.

At the same time, the end of the de minimis threshold has amplified the need for brands to switch to domestic multinode fulfillment. By repositioning inventory into the U.S., brands can mitigate the risks brought by sudden trade policy changes. However, brands that operate using a centralized or single-node infrastructure for order fulfillment may find it increasingly difficult to meet these rising customer expectations and realize the advantages of switching to domestic fulfillment.

For brands determined to remain competitive, it may be time to move toward a multinode fulfillment strategy that can support seasonal peaks and long-term growth.

What is Multinode Fulfillment?

Multinode fulfillment refers to a distribution network where businesses store inventory and fulfill orders using multiple strategically located facilities or ‘nodes’ that bring products closer to end consumers. It’s the same principle that powers the logistics behind retail giants. They leverage their vast network of fulfillment centers and 3PLs to enable two-day or even same-day shipping across much of the U.S.

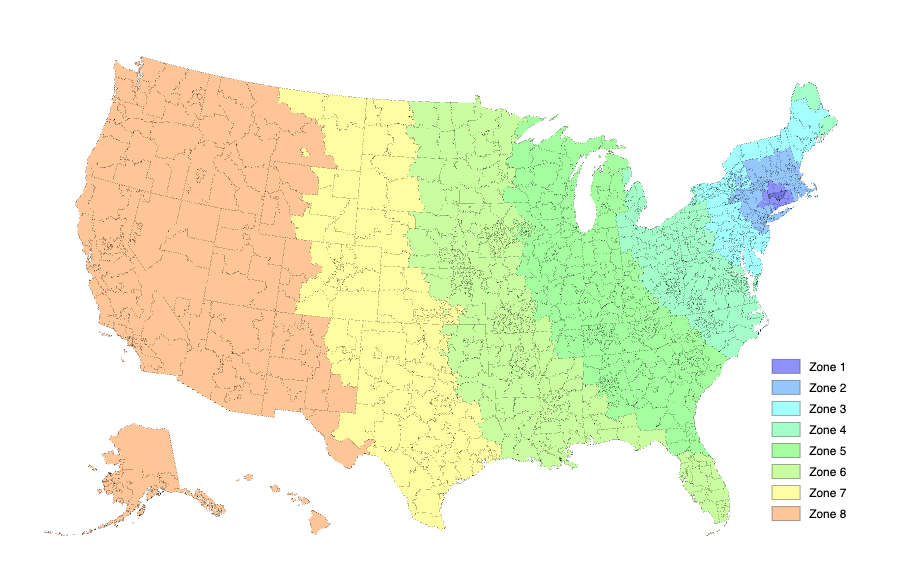

At the heart of this strategy is the concept of shipping zones, a major factor that impacts both cost and delivery speed. Shipping zones are geographic regions defined by carriers like UPS, FedEx, and USPS based on the distance between the origin (your warehouse or fulfillment center) and the destination (your customer). While the general principle is similar, each carrier may have slightly different zone definitions and calculations based on their own network and infrastructure. Generally, the farther a package has to travel, the higher the shipping zone and the more it costs to ship.

For example, an order shipped from New York to New Jersey may fall into Zone 2, while that same package shipped to California could be Zone 8.5

While domestic zone structures are distanced-based, international zones depend on the country-to-country relationship. For instance, sending a package from the U.S. to Europe may follow a different zone model than sending one to Asia, even if the distance travelled is similar. International zone mapping is influenced by tariffs, customs, and trade regulations of the origin and destination countries.

Once a package arrives in the destination country, however, it will go through the same logic of local shipping zones to determine the additional shipping costs for the final mile of delivery.

So whether shipping domestically or internationally, reducing shipping zones remains one of the most effective ways to optimize your fulfillment network for both cost and speed, and multinode fulfillment is how you make that happen.

Considerations for Going Multinode

Not every business needs a multinode fulfillment strategy. While the model offers distinct advantages in speed and scalability, it also introduces new layers of logistical complexity and cost. The decision to adopt a multinode fulfillment strategy hinges on several key considerations:

Order Volume and Growth

Order volume is often the first indicator that it may be time to shift to a mul tinode fulfillment strategy. Brands fulfilling over 1,000 orders per month,6 especially with consistent month-over-month growth, should begin assessing whether a distributed fulfillment model could enhance performance and reduce costs.

Moreover, there’s also a need to take into account order predictability. Multinode fulfillment relies on demand forecasting and order history to accurately place inventory across nodes. Brands need strong, trackable SKU-level data to identify which products should be stored where.

If historical order patterns show consistent regional demand, such as a high volume of specific SKUs shipping repeatedly to the West Coast, that’s a sign that splitting inventory across locations could reduce shipping time and cost. In addition, if your brand is seeing consistent, predictable demand for international customers, leveraging a multinode approach can help minimize the cost volatility of international trade. Sending products in bulk to local warehouses overseas can help reduce tariffs, duties, and international shipping fees compared to fulfilling individual direct-to-consumer (DTC) cross-border shipments.

On the other hand, brands with sporadic or unpredictable order volumes may find multinode strategies premature. Without reliable historical data or trends to guide decisions on how and where to place inventory, brands risk overstocking or facing stockouts in certain regions, both of which can quickly undermine any operational advantage.

Customer Size and Spread

Increasing order volume, especially from new regions, typically signals that your customer base is expanding. Keeping track of the origin of each order can reveal clear regional patterns. Once a consistent concentration of orders begins to emerge from a particular area of the country, it may be time to consider placing the right inventory in that region. Doing so allows you to serve a growing segment of your customer base more efficiently.

By adding a fulfillment node nearer to a significant cluster of end consumers, the brand can shorten delivery windows, reduce parcel costs, and strengthen its competitive position in that market, all while alleviating pressure on the original facility.

Understanding where your customers are and how their geographic distribution shifts over time is key to knowing when a single-node model is no longer sufficient.

Service Level Commitments

Delivery promises, like guaranteed two-day or next-day delivery, are often what push brands toward a multinode strategy. This becomes especially critical in categories where fast delivery is a key differentiator—think commodity products in saturated markets with minimal variation between competitors. When everyone is selling similar products of the same quality and price point, delivery speed becomes a great deciding factor.

A distributed network allows brands to position inventory closer to high-demand zones, reducing transit time and expanding the ability to aggressively meet delivery promises without relying on costly express or air freight services.

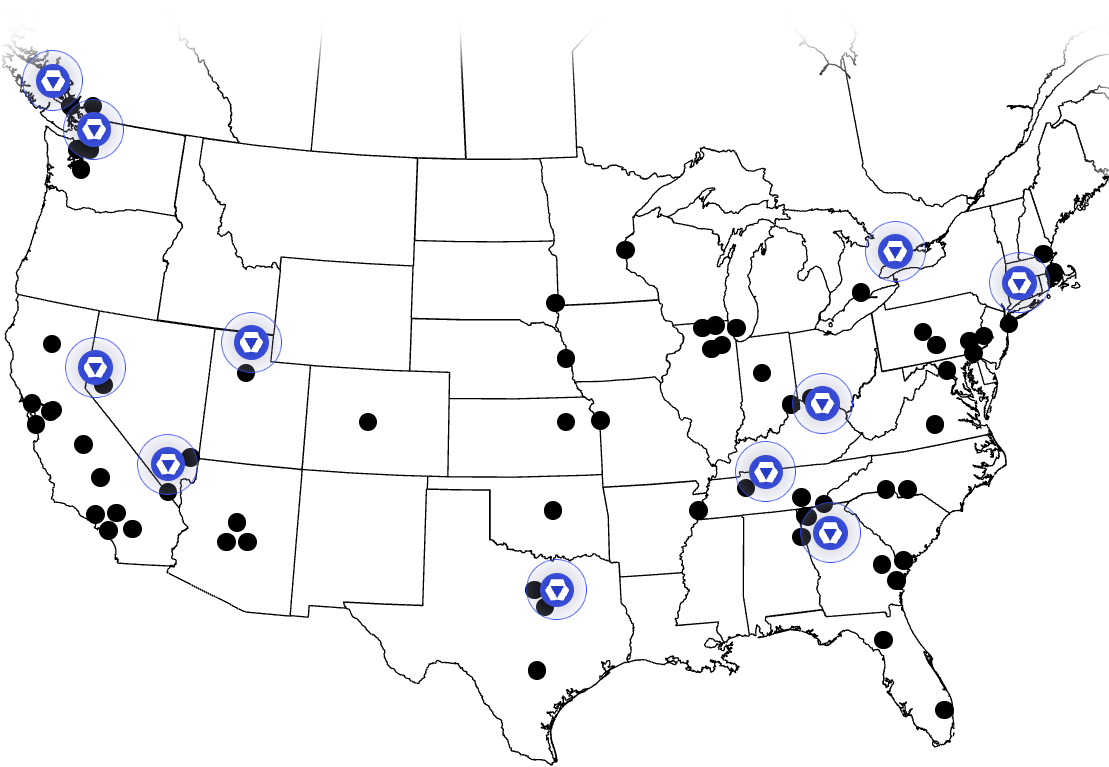

This is exactly the kind of advantage enabled by fulfillment providers like Stord, whose distributed fulfillment network offers 99.5% U.S. coverage in under two days. With strategically located facilities and partners across the country, Stord helps brands expand premium service level reach without building out infrastructure on their own.

This kind of capability is especially valuable for fast-scaling brands that need flexibility and speed, less the overhead and operational complexity of managing multiple warehouses and fulfillment centers directly.

Moreover, a multinode fulfillment strategy adds a layer of resilience. Disruptions such as power outages, extreme weather events, warehouse shutdowns, or worker illness can cripple operations in a single-node model. With multiple fulfillment centers, brands can reroute orders and maintain service levels even during unexpected interruptions.

Product Characteristics

The type of product being sold heavily influences the viability of a multinode approach. Apart from the distance between the order’s origin and destination, the shipping rate will also depend on the order's weight and dimensions. Shipping large, heavy, or bulky items across long distances significantly increases parcel costs.

Here’s an illustrative comparison for a large, bulky package weighing 60lbs with dimensional weight applied, shipping from ZIP 10001 (NYC) to various zones using UPS’ 3 Day Select7:

Destination Shipping Zone | Approx. Distance | Total Cost (60lb) |

|---|---|---|

Zone 2 | East (e.g., NJ/PA) | $85.16 |

Zone 4 | Midwest (e.g., IL) | $135.55 |

Zone 6 | Texas/CO/etc. | $277.76 |

Zone 8 | Far West (e.g., CA) | $367.08 |

All figures pulled from stated UPS rates. These can be significantly reduced through Stord Parcel.

That same item, when shipped from a fulfillment center in the Midwest or on the West Coast instead of the East Coast, may only need to travel to Zone 4 instead of Zone 8. In this case, adding a new node made it possible to cut parcel costs by more than half. These savings scale quickly when applied across hundreds or thousands of orders per month.

If your product catalog includes these types of items, and you’re seeing consistent regional demand, adding just one additional fulfillment node can deliver substantial savings for your brand and lead to better end consumer experiences by minimizing both transit time and per-unit shipping cost.

However, brands that offer highly customizable or made-to-order items may find multinode fulfillment more challenging. These products often require specialized handling, longer lead times, or centralized production, which makes distributing inventory across multiple nodes inefficient or operationally risky. In such cases, a centralized model may still be the best fit until production and fulfillment can be standardized.

Infrastructure and Operational Costs

The cost of going multinode is significant, and brands need to evaluate it holistically. This includes not only the costs of storage, labor, and shipping, but also systems integration, inventory management software, and coordination across facilities. The operational overhead of managing multiple warehouses each with its own receiving, picking, packing, and shipping processes should not be underestimated.

However, costs can often be offset by efficiencies. Shorter delivery times, reduced parcel costs, and improved customer satisfaction can drive stronger business outcomes over time. Faster fulfillment can lead to fewer cart abandonments8 and better customer retention.

Ideally, total shipping costs should stay below 15% of your brand’s average order value (AOV).9 Anything more than that puts pressure on your margins. A good benchmark to monitor is when shipping costs begin to eat up almost 10% of your brand’s total revenue, it may be time to seriously consider a shift to a multinode fulfillment model.

Partnering with a reliable fulfillment provider like Stord can also ease the financial and operational burden of going multinode. Rather than building your own physical infrastructure or exploring the complexity of managing multiple 3PL relationships, brands can leverage Stord’s integrated network and platform to centralize visibility, automate fulfillment workflows, and streamline inventory distribution. This allows brands to scale their logistics operations without proportionally scaling overhead or system complexity, making multinode execution more accessible and cost-efficient from day one.

Scaling Smart with Multinode Fulfillment

For the right brands, at the right stage, multinode fulfillment opens the door to faster delivery, stronger regional coverage, better service level performance, and more scalable and sustainable growth.

Understanding when to make the shift, and when not to make the shift, is just as crucial as the strategy itself. The decision should be driven by data and involve careful planning and operational readiness.

A well-timed move to multinode can transform fulfillment into a competitive advantage. The brands that succeed will be the ones that scale their logistics with intention, precision, and a clear focus on the consumer experience.